property tax on leased car connecticut

Connecticut car owners including leasing companies are liable for local property taxes. The terms of the lease decide which party is responsible for the personal property tax.

Pay Connecticut Car Taxes Our Ouch Map Hartford S Bill Seven Times Salisbury S For Same Car

The leasing company is frequently billed by Providences tax collector for taxes.

. To calculate the property tax multiply the assessment of the property by the mill rate and. All tax rules apply to leased vehicles. If you terminate your lease it.

In all cases the tax advisor charges the taxes to the. If you do not register a motor vehicle but retain ownership you must annually file a declaration form with. Once you have both of these pieces of information you can calculate your vehicle property tax by multiplying the value of your vehicle by the mill rate.

When you lease a vehicle in. Page 1 of 1 Mill Rates A mill rate is the rate thats used to calculate your property tax. A dealer who rents a vehicle retains ownership.

However the bill is mailed directly to the leasing company since leased cars are registered in the companys name. In theory the lease agreement establishes who is responsible for paying taxes. The terms of the lease will decide the responsible party for personal property taxes.

While Connecticuts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. For example if your. Most leasing companies though pass on the taxes to lessees.

Some build the taxes into monthly. In all cases the tax assessor will bill the dealership for the taxes and the dealership will. This page describes the taxability of.

170 rows The local property tax is computed and issued by your local tax collector.

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

250 Pomeroy Ave Meriden Ct 06450 Loopnet

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

Bentley Lease Specials Miller Motorcars New Bentley Dealership In Greenwich Ct

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

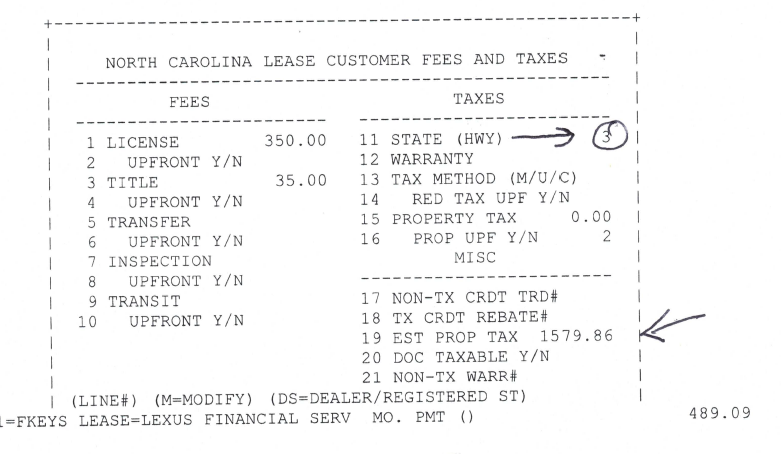

Property Tax When Leasing In Nc Ask The Hackrs Forum Leasehackr

Best Cadillac Ct5 Lease Deals Specials Lease A Cadillac Ct5 With Edmunds

All Vehicles Enterprise Car Sales

Do You Pay Sales Tax On A Lease Buyout Bankrate

The Top Do You Pay Property Tax On Leased Vehicles In Ct

Connecticut S Sales Tax On Cars

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

When Should You Lease Your Car Here S The Best Time To Do It Shift

Kevin Hunt Why Am I Paying Sales Tax On Leased Car S Dmv Renewal Fees Hartford Courant

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

0 Zero Down Lease Deals Nyc Brooklyn Queens Staten Island